If you’re adopting HReasily midway through the financial year, you’ll likely have historical payroll data to update. This is particularly important if you’re using the computerised calculation method for PCB/MTD, as the system requires prior income and contributions to accurately calculate deductions for the following months.

HReasily provides two ways to update historical payroll information:

Option 1: Run Ad-Hoc Payroll (Recommended)

This method allows you to generate backdated payslips and monthly payroll reports for employees while maintaining accurate statutory contributions.

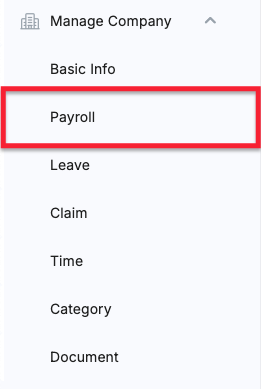

1. Go to Manage Company > Payroll.

2. Scroll to the Adhoc Payroll section and click Create Adhoc Payroll.

3. In the pop-up, select the backdated payroll period (e.g., 01 Jan – 31 Jan 2025) and click Create.

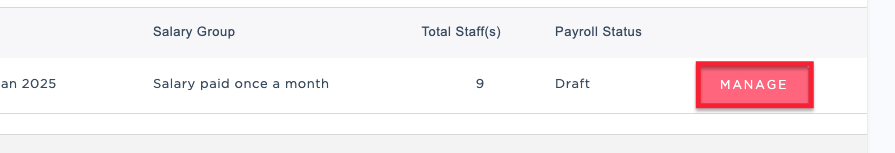

4. Once generated, click Manage.

5. Enter the historical payroll data for each employee in the table and click Approve.

6. Repeat for all subsequent months until all backdated payroll is processed.

Important Note: Slight differences in statutory calculations can happen because of previous errors or non-compliant software. Since these contributions have already been processed, the backdated entries need to match exactly. To achieve this, disable HReasily's automated calculation so you can manually adjust the statutory amounts.

Option 2: Update Historical Income on the Employee Payroll Info Page

This method directly updates each employee’s total income and deductions without generating payslips.

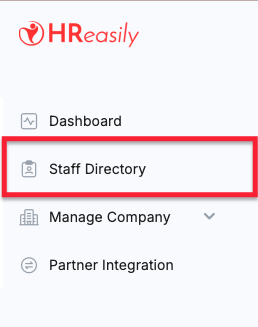

1. Go to Staff Directory option on the left sidebar.

2. Locate the employee, select Payroll Info from the dropdown, and click Go.

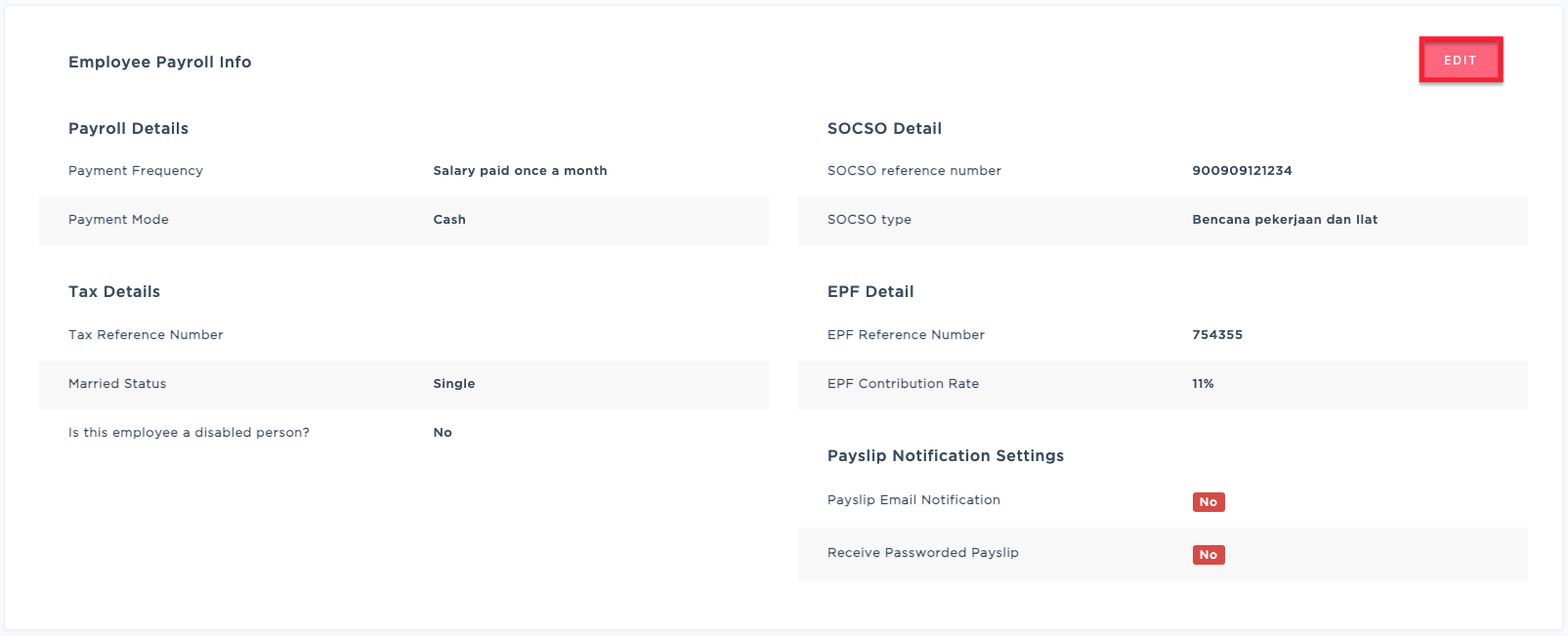

3. Scroll to the Employee Payroll Info section and click Edit.

5. Scroll to the Tax Details section, expand each section and enter the following:

- Gross Income & Total Accumulated MTD

- EPF, Socso, and EIS deductions

- Benefit-in-Kind (if applicable)

- Tax-exempted Allowances (if applicable)

Fill in the employee’s income under Current Employment. For employees who joined mid-year, enter past income from their previous employer under Previous Employment.

Both methods will give you an accurate EA form for year-end tax filing. However, Option 1 is strongly recommended, as it also provides backdated payslips and monthly payroll reports, giving you a more complete historical record.

Was this article helpful?

That’s Great!

Thank you for your feedback

Sorry! We couldn't be helpful

Thank you for your feedback

Feedback sent

We appreciate your effort and will try to fix the article